Modern technology has birthed more and more scams since it was invented. There are different ways scammers reach their victims. This could be through text or SMS, phone, email, websites, etc. The list is endless.

Whatever way you chose to look at it, technology or the internet has massively contributed to it. Either directly (social engineering scams) or indirectly (getting people’s information online and using it to commit fraud)

Common Types of Scams

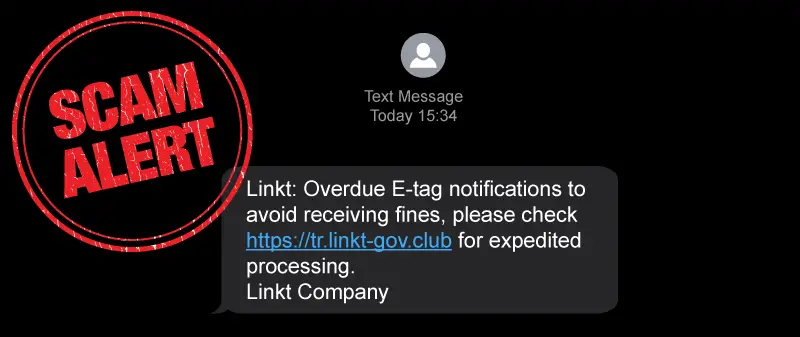

SMS Scams – Smishing

Scam messages look like they are from the government, businesses you deal with or even your own family or friends to try to catch you out.

They sound urgent to get you to act quickly. They often have a link which will take you to a scam website. Scammers can steal any personal information entered on these scam websites and use it to take your money or commit fraud in your name.

To make these message look real, scammers spoof (copy) the phone number and sender ID of businesses or people you know. Scam messages can even appear in the same message chain as real messages from the organisation, making them even harder to spot.

Phone Scams

According to reports, 1 in 3 scams happen by phone. Scammers call, claiming to be from well-known organisations. This includes government organisations, law enforcement, delivery, law firms, banks, telecommunication providers, e.t.c

They sound urgent to get to you act quickly. They may try to convince you to give them your personal or bank account details, or remote access to your computer. The caller may already have some details about you, such as your name or address.

What you should do; Screen unknown numbers. If you are not sure if a caller is who they say they are, it’s ok to hang up. Let calls from unknown phone numbers go to voicemail.

Scams Via Email – Phishing

Common scams via email include:

- asking you to confirm your banking details so they can give you a ‘refund’

- providing you with a phone number to call urgently

- informing you that you’ve been selected to receive a lottery donation

- making a threat such as immediate arrest, deportation, or blackmail

- threatening to stop a service or charge a fine if you don’t act

- stating you’ve been a victim of identity crime and offering compensation or help to recover money lost to scams

What do do: Access the organisations’ secure, authenticated portal or app directly (never via a link). Contact the organisation or person using details you have found yourself (on their website or in the phone book) to check if the email was real

Do not click on links or download attachment from an unknown or unverified sender. Always do due diligence no matter how trustworthy the email looks. Have a Zero Trust rule that goads you into verifying the source of an email before responding to it.

Websites Scams

Scammers can pretend to be anyone online to deceive you into trusting them. They may create fake websites to look like well-known brands. They impersonate famous people and make it look like they recommend the product or service. Then they use fake reviews to make you trust them. Sometimes you will receive a knockoff of the item you thought you purchased. Other times you will receive nothing at all.

Warning signs it might be a scam

- sells items at significantly lower prices than usual or compared to other sites

- has something unusual about the payment method, like only offering a single payment option or asking for payment in gift cards or Bitcoin

- only includes positive reviews or reviews that are light on detail

Investment Scams

Investment scam is a fraud involving fake crypto or stock investment websites set up by cybercriminals. The scammers often use a well designed website, display stocks prediction, and promise unreliastic returns.

The minimum deposit could be $50 to make people lower their guards. They often show intending victims fake profits and then goad them to invest more and more money. When it’s time to withdraw the earnings, the real scam kicks off; you’d be told to pay a processing fee after which you’d be blocked from accessing the website or contacting them.

What You should do: If an offer appears too good to be true, it probably is. Research any investment opportunity fully before investing money. Do not trade with unregulated brokers or platforms. Always do due diligence by searching the web for reviews, if there’s none, back off. You can also check how long the platform has been existing by using Who.is domain checker. If it is not up to a year or two years, it’s certainly questionable.

Employment Scams

Fraudsters go as far as impersonating reputable companies, then send job seekers text messages about a remote job. A high pay is often cited, however, it’s all part of the scheme. Once they’ve established the trust, they’d proceed in their scam which could be disguised as ‘equipment fee’ ‘training fee’ ‘upgrade fee’ etc.

What to do: When you’re offered a job always remember the saying ‘If It’s too good to be true, it certainly isn’t true’. When approached by a job recruiter either online or offline, the first thing to do is research the company and the job opportunity. Find the company on the internet and review their online presence, including their social media. Enter the company’s name and the word “scam” on search engine, paste the email address too to find out if it has been flagged as scam.

Romance Scams

Scammers use dating websites, social networks and chat rooms to get personal details or money from people. Romance scammers don’t prey on a specific gender, sexuality, race or age. The scammers often use the pictures and videos of another person, sometimes a celebrity. They may spend time getting to know you and developing trust to fool you into thinking the relationship is real before asking you for money, a loan, or access to your finances.

What you should do

When online dating, start off with a reputable website. Look out for someone asking lots of questions but not giving any detail about themselves. Don’t ever hand over any money or send them valuable goods and never let anyone you don’t know or trust transfer money into your bank account

False Advertising Scams

Most products are advertised and sold with over-exaggerated claims. False advertising is a scam as it use various techniques to manipulate the buyer into making a purchase. For example, one of the fast-growing product scams are ‘electricity saving box’. This scam claims a small white box when plugged in a power outlet can filter dirty electricity and cut down electricity costs. Of course, the box doesn’t work and buyers end up wasting their hard earned money.

There are a lot of product false advertising scams out there; fake weight loss products, mosquito zappers, portable heaters, e.t.c

What to do: Always search for genuine reviews online before buying any product. Back off from any product making outlandish claims that aren’t backed by scientific research and findings.